Explain Different Types of Risks Associated With Unsystematic Risk

Errors in entrepreneurial judgment. Systematic risk is uncontrollable by an organization and macro in nature.

Systematic Vs Unsystematic Risk The Key Differences Upwork

Unsystematic risk is due to the internal factors and hence can be controlled or reduced.

. Examples of Unsystematic Risks. Components of The Unsystematic Risk However the unsystematic risk of investment consists of two major components. A change in regulations that impacts one industry The entry of a new competitor into a market A company is forced to recall one of its products A company is found to have prepared fraudulent financial statements A union targets a company for an employee.

Examples of unsystematic risk are as follows. Change in regulations impacting one industry The entry of a new competitor in the market A firm forced to recall one of its products Eg the Galaxy Note 7 phone recalled by Samsung due to its battery. There are other terms such as common share ordinary share or voting share that are equivalent to common stock.

I believe the ultimate risk is permanently losing your capital. It can be planned so that necessary actions can be taken by the organization to mitigate reduce the effect of the risk. Unsystematic risk is related to the specific industry segment or security while the Systematic risk is the loss associated with the entire market or the segment.

Business risk is the risk inherent in the nature of the business. Systematic risk is due to the influence of external factors on an organization. Financial or credit risk.

But just like systematic risk unsystematic risk has many faces and foreseeing all its manifestations would be very difficult for an individual investor. Some of the other examples of unsystematic risks are. Investors by their very nature wish to achieve good returns on their investments and that too mostly without taking disproportionate risks.

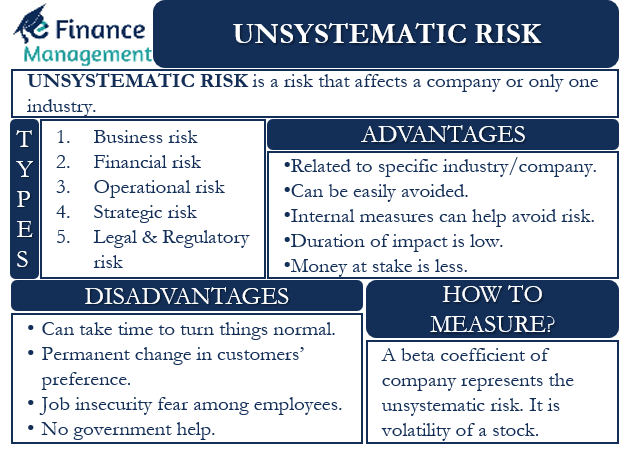

Business or liquidity risk. There are five types of unsystematic risk. Examples of unsystematic risk are listed below.

Nevertheless they are usually grouped in two categories. Next Post Next Dr. Types of unsystematic risk include a new competitor in the marketplace with the potential to take significant market share from the company invested in a regulatory change which could drive down company sales a shift in management and a product recall.

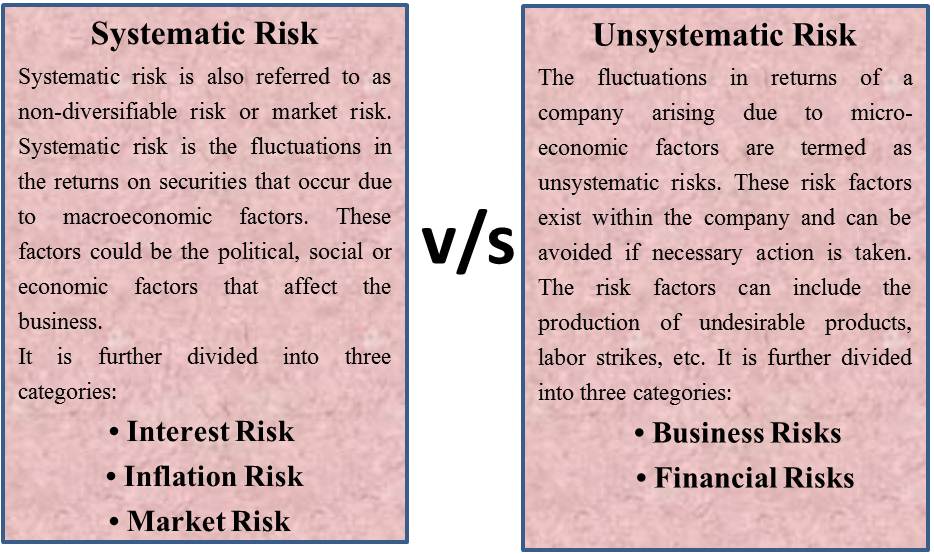

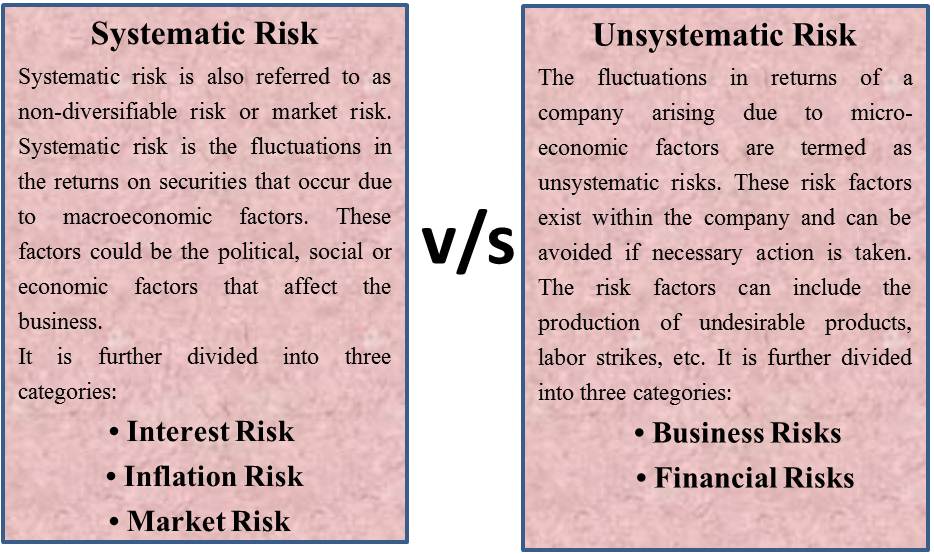

Unsystematic risk described as the uncertainty inherent in a company or industry investment. Unsystematic risk is controllable by an organization and micro in nature. Explain the difference between systematic and unsystematic riskAlso explain why one of these types of risks is rewarded with a risk premium while the other type is not.

Unsystematic risk also known as diversifiable risk or non-systematic risk is the danger that relates to a particular security or a portfolio of securities. Unsystematic Risk Asset-specific or company-specific uncertainty. This unfortunately is an inherently contradictory desire as high returns are always associated with greater risk.

Unsystematic risk also known as company-specific risk specific risk diversifiable risk idiosyncratic risk and residual risk represents risks of a specific corporation such as management sales market share product recalls labor disputes and name recognition. Large number of securities in the market. In order to avoid the ultimate risk you need an to employ portfolio risk management strategiesPart of this plan is to understand systematic and unsystematic risk and the most effective approaches to mitigating these risks.

Credit risk sometimes called company risk consists of business risk and financial risk. By contrast systemic risk that applies to an entire economy industry or sector is more difficult to reduce with diversification. Interest risk market risk and purchasing power risk.

Financial Risk The capital structure of a company degree of financial leverage or debt burden Interest Rate Risk The impact of changing interest rates. Common Stock Common stock is a type of security that represents ownership of equity in a company. Murphy is examining factors associated with retention in a.

Unsystematic risk is a micro in nature as it affects only a particular organization. Unsystematic risk is the risk that occurs because of a companys operation while systematic risks are those occurring in the market that cannot be avoided by diversification of stocks. The types of risk grouped under unsystematic risk are depicted below.

External Business Risk. The current economic scenario provides investors. Business risk financial risk operational risk strategic risk and legal or regulatory risk.

Investors construct diversified portfolios in order to allocate the risk over different classes of assets. This type of risk is peculiar to an asset a risk that can be eliminated by diversification. Unsystematic risk refers to the risk associated with a particular security company or industry.

PoliticalRegulatory Risk The impact of political decisions and changes in regulation. Business risk and financial risk. External business risk stems from the nature of the industry that a company operates in.

Outcomes of legal proceedings. The meaning of systematic and unsystematic risk in finance. Systematic risk on the other hand is uncontrollable.

Unsystematic Risk is any risk that is specific to a company as opposed to the entire economy or an entire industry. Idiosyncratic risk also sometimes referred to as unsystematic risk is the inherent risk involved in investing in a specific asset such as a stock. There are many types of investing risk.

Generally speaking investors can reduce their exposure to unsystematic risk by diversifying their investments. Systematic and Unsystematic Risk.

Unsystematic Risk Meaning Types Advantages And More

Systematic Vs Unsystematic Risks Meaning Key Differences Efm

Comments

Post a Comment